1 of the current. This takes into account the rates on the state level county level.

Is Food Taxable In Arizona Taxjar

However please note that tax rate.

. Tempe Arizona and Dallas Texas. This includes the sales tax rates on the state county city and special levels. The 81 sales tax rate in tempe consists of 56 arizona state sales tax 07 maricopa county sales tax and 18 tempe tax.

Arizona Sales Tax Calculator and Economy Summary The average cumulative sales tax rate in the state of Arizona is 775. Business codes region codes and city codes can be found on the tax rate table. Download all Arizona sales tax rates by zip code The Tempe Arizona sales tax is 810 consisting of 560 Arizona state sales tax and 250 Tempe local sales taxesThe local sales tax consists of a 070 county sales tax and a 180 city sales tax.

Tempe Arizona Sales Tax Rate and Calculator 81 Average Sales Tax For Tempe Arizona Summary The average cumulative sales tax rate in Tempe Arizona is 81. Click The Logo Below To View The Model City Tax Code. The combined rate used in this calculator.

Tempe AZ Sales Tax Rate Tempe AZ Sales Tax Rate The current total local sales tax rate in Tempe AZ is 8100. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Once you have a budget in mind multiply that number times the decimal conversion of the sales tax percentage in your municipality.

The County sales tax. Tempe is located within Maricopa County Arizona. Apply or Renew on the Accela Citizen AccessACA Portal.

2022 Cost of Living Calculator for Taxes. The Tempe Sales Tax is collected by the merchant on all qualifying sales made within Tempe. Temple Bar Marina AZ Sales Tax Rate.

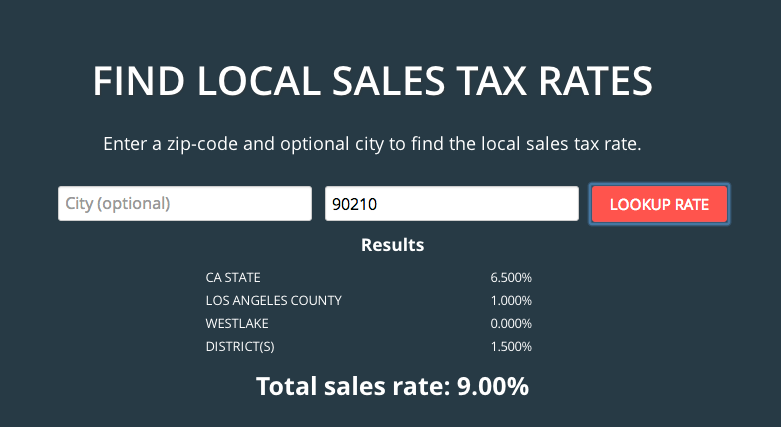

Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax. The 85281 tempe arizona general sales tax rate is 81. How 2022 sales taxes are calculated in tempe.

Groceries are exempt from the. The Arizona sales tax. This will give you the sales tax you.

Sales tax in Tempe Arizona is currently 81. The December 2020 total local sales tax rate was also 8100. 100 Working Tempe Camp sales tax calculator Updated 2021 and providing the best and accurate results you can get non other than on 360 taxes.

The minimum combined 2022 sales tax rate for Tempe Arizona is. Texas are 20 more expensive than Tempe Arizona. However you may need either a Transaction Privilege Tax License aka TPT or sales tax license and a Tempe Regulatory License.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Tempe AZ. Tempe AZ Sales Tax Rate. A The tax rate shall be at the amount equal to one and eight-tenths percent 180.

The average sales tax rate in arizona is 7695. Most transactions of goods or services between businesses are not subject to sales tax. The calculator will show you the total sales tax amount.

Tempe Junction AZ Sales Tax Rate The current total local sales tax rate in Tempe Junction AZ is 6300. What Businesses Are Taxable And At What Tax Rate. Modify Section 16-460a entitled Retail Sales.

Higher sales tax than 58 of Arizona localities 28 lower than the maximum sales tax in AZ The 81 sales tax rate in Tempe consists of 56 Arizona state sales tax 07 Maricopa County. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax. Interactive Tax Map Unlimited Use.

Cost of Living Indexes. Apply File Pay Transaction Privilege Tax TPT or sales tax at AZTaxesgov. The December 2020 total local sales tax rate was also 6300.

Tempe Junction AZ Sales Tax Rate. This is the total of state county and city sales tax rates. The Arizona sales tax rate is currently.

Arizona Sales Tax Calculator You can use our Arizona Sales Tax Calculator to look up sales tax rates in Arizona by address zip code. The sales tax rate for Tempe was updated for the 2020 tax year this is the current sales tax rate we are using in the Tempe Arizona Sales Tax Comparison Calculator for. Free sales tax calculator tool to estimate total amounts.

TPT and Other Tax Rate Tables are updated monthly. Ad Lookup Sales Tax Rates For Free. S Arizona State Sales Tax Rate 56 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the.

2021 Arizona Car Sales Tax Calculator Valley Chevy

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona Sales Tax Guide And Calculator 2022 Taxjar

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Olin Business Solutions Pllc Az Sales Tax Calculator Obs Is A Licensed Cpa Firm Providing Accounting Services In Yuma Arizona

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Do This To Save 16 On Every Marijuana Purchase In Arizona

Transaction Privilege Tax Tpt Or Sales Tax City Of Tempe Az

Arizona Paycheck Calculator Smartasset

Arizona Sales Tax Small Business Guide Truic

Property Taxes In Arizona Lexology

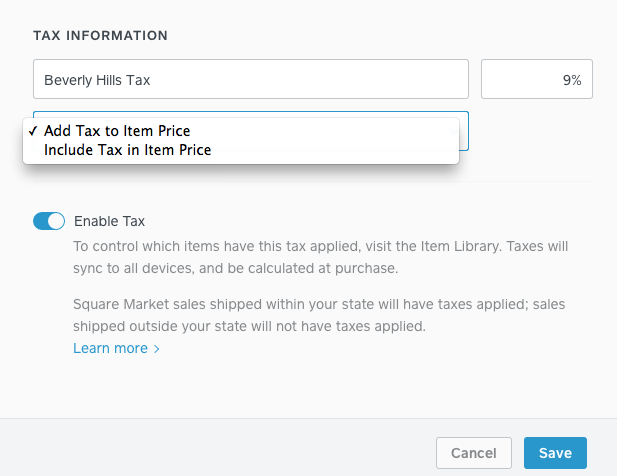

How To Collect Sales Tax Through Square Taxjar

How Does Reverse Sales Tax Calculator Arizona Work 360 Taxes

Arizona Sales Reverse Sales Tax Calculator Dremployee

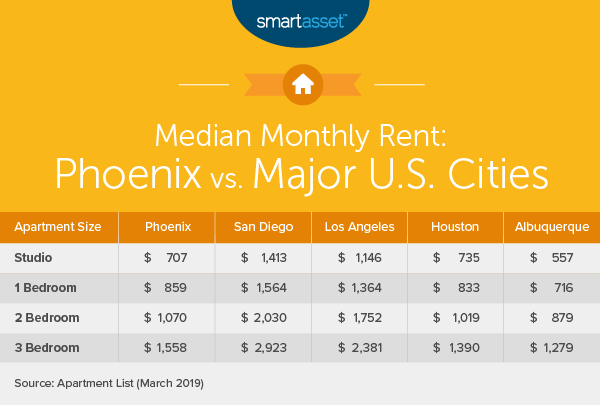

Cost Of Living In Phoenix Smartasset

Arizona Sales Tax Small Business Guide Truic